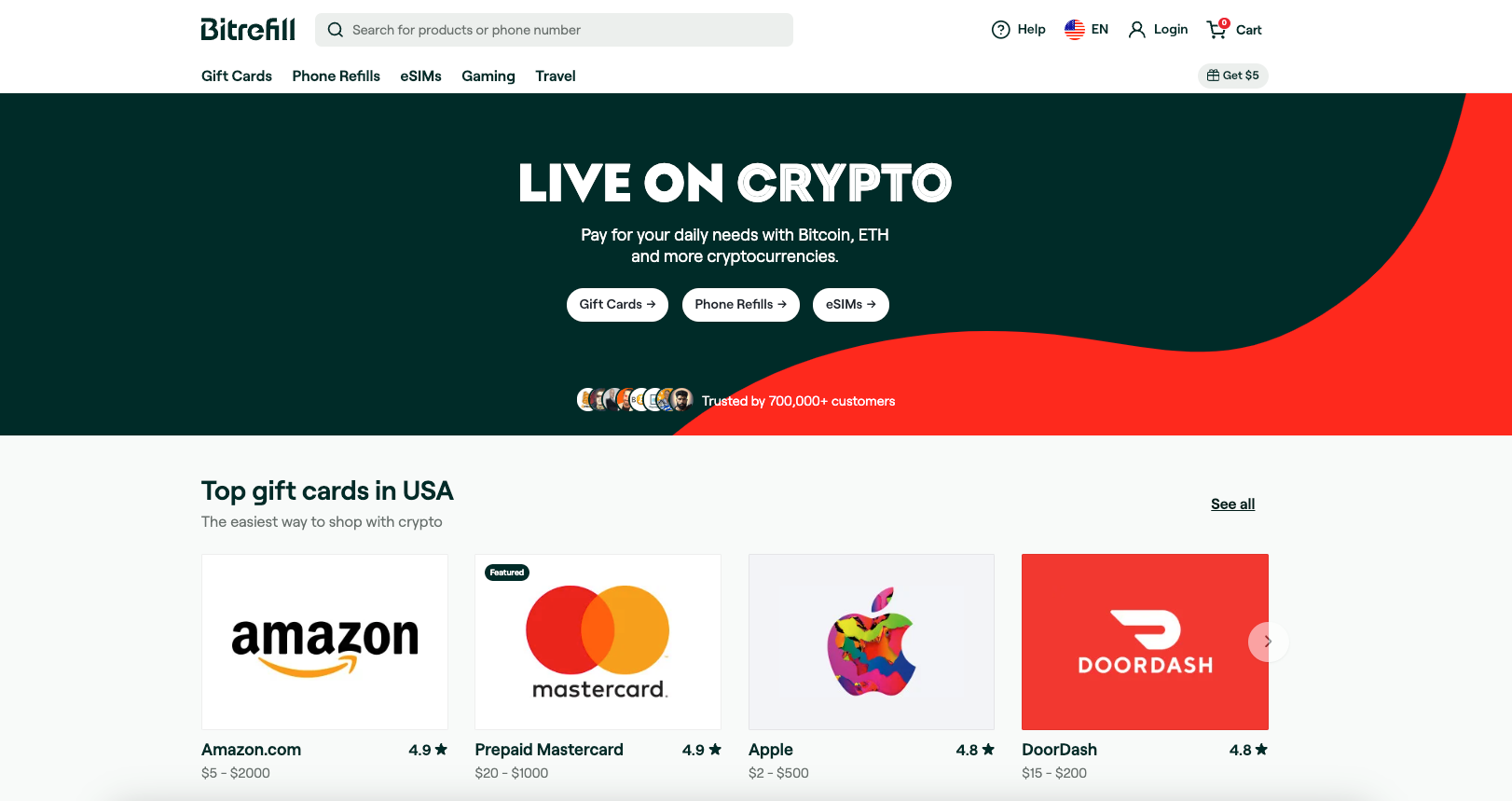

🥇 Bitrefill - Premier Choice for Online Crypto Shopping & Card Services

Bitrefill, renowned as a leading crypto ecommerce platform, offers an extensive array of products like gift cards, phone refills, and eSIMs. Its standout feature is the ease of access it provides; customers can effortlessly make purchases without the need for a credit card or an account.

The Bitrefill Card has rapidly gained popularity in the crypto card arena, celebrated for its remarkable versatility, transparency, and convenience for users. It uniquely supports a wide range of cryptocurrencies including BTC, ETH, USDT, and USDC, and is commended for its clear fee structure, free from hidden charges.

This, combined with a high monthly limit of up to 15,000 EUR, cements its status as a top choice for managing crypto transactions.

Features to Note:

- Multiple Cryptocurrency Support: Top-ups with BTC, ETH, USDC, and more.

- Transparent Fee Policy: Minor conversion fees, no hidden costs.

- Substantial Spending Limit: Up to €15,000 monthly, exceeding many rivals.

- Wallet Compatibility: Works with Google Wallet and soon with Apple Pay.

- Privacy Commitment: GDPR compliance ensures data security.

Conclusion: In the realm of crypto cards, you won't find a more comprehensive, user-friendly, and versatile option than Bitrefill. This is not just a card; it's your key to unlocking the full potential of your cryptocurrency in the global marketplace.

2) Coinbase Card - A Tailored U.S.-Focused Crypto Card

The Coinbase Card, a Visa debit card linked to Coinbase accounts, is acknowledged for its user-friendliness and security, enabling users to spend crypto assets effortlessly at Visa-accepting locations.

While praised for its convenience, users should be aware of its higher fees and limited reward options compared to other crypto cards. Additionally, it has a monthly spending cap which might restrict the potential rewards.

Key Features:

- Visa Debit Functionality: Accepted globally.

- Coinbase Integration: Direct link to Coinbase accounts.

- Dual Spending Options: Use USD balance or convert crypto.

- Rewards Program: Diverse crypto rewards for certain purchases.

3) Crypto.com Card - A Must-Have for Dedicated Crypto Enthusiasts

The Crypto.com Card, a popular choice in the market, provides an effective way to utilize cryptocurrency for daily transactions, offering up to 5% cashback in CRO tokens.

This prepaid card supports both fiat and crypto top-ups and is usable worldwide wherever Visa is accepted. However, high staking requirements for maximum rewards and various fees could be potential drawbacks for some users.

Key Features:

- Prepaid Visa Card: Broad acceptance.

- CRO Token Benefits: Linked rewards for staking.

- Various Top-Up Options: Support for multiple currencies.

- Tier-Based Rewards: Up to 5% cashback in CRO.

4) Venmo Crypto Card

The Venmo Credit Card offers a unique solution for individuals interested in both purchasing and spending cryptocurrency seamlessly in one platform. This card is particularly suited for those who are already familiar with or looking to delve into the world of cryptocurrencies, while also desiring the traditional functionalities of a credit card.

Key Aspects of the Venmo Credit Card:

- No Annual Fee: This feature makes the card accessible without worrying about an additional yearly cost.

- Integrated with Venmo App: Offers seamless management of spending, rewards, and crypto purchases all within the Venmo app.

- Mobile Wallet Compatibility: The card can be added to Apple Pay®, Google Pay™, or Samsung Pay® for convenient and fast transactions.

- Visa Credit Card Benefits: Includes touch-free shopping and security features. Visa Signature® cardholders also get extra travel and lifestyle perks.

- Unique QR Code for Easy Splitting of Bills: The card comes with a QR code that links to the user’s Venmo account, simplifying the process of splitting bills.

Considerations:

- Credit Approval: Application involves a credit check, which could impact credit scores.

- Variable Reward Categories: While flexible, the shifting reward categories require users to be aware of their current top spending categories to maximize rewards.

- Crypto Market Volatility: The option to convert cashback into cryptocurrency exposes users to the volatile nature of the crypto market.

Overall, the Venmo Credit Card is a forward-thinking financial tool that aligns with the needs of modern consumers who are interested in both the convenience of a credit card and the innovative potential of cryptocurrencies. It's an especially compelling option for those who wish to explore and invest in crypto while enjoying the benefits of a versatile cashback credit card.

5) Gemini Crypto Card

The Gemini Credit Card® is designed for those interested in integrating cryptocurrency rewards into their everyday spending. It stands out for its unique feature of providing crypto rewards instantly upon each purchase, a significant deviation from the typical monthly reward distribution seen in other cards.

Its unique instant reward feature, combined with a suite of security and user-friendly perks, positions it as a strong contender in the crypto credit card market.

Key Aspects of the Gemini Credit Card®:

- Crypto Rewards on Every Purchase: Users earn rewards in bitcoin, ethereum, or from a selection of over 40 cryptocurrencies available on Gemini.

- No Annual Fee: This is an attractive feature, especially for those who are cautious about recurring charges.

- Customizable Card Options: Users can choose from black, silver, or rose gold metal cards, designed with a focus on security (card number is not printed on the card).

- Security Features: The card boasts of Gemini's high-standard security measures, including two-factor authentication and advanced encryption.

- No Foreign Transaction Fees: This feature, along with the absence of exchange fees for acquiring crypto rewards, enhances its appeal for international transactions.

Considerations:

- Variable APR: The card comes with variable annual percentage rates, which could be a consideration for those who tend to carry a balance.

- Crypto Market Volatility: Since the rewards are in cryptocurrency, the value of these rewards can fluctuate significantly.

- Limited to U.S. Residents: Currently, the card is only available to residents of the 50 U.S. states.

Conclusion: Why Bitrefill Card Stands Out

In summary, the Bitrefill card provides an unmatched blend of ease, flexibility, and transparency. It's designed for the modern consumer who values straightforward, secure, and efficient use of their digital assets. With its high spending limit, broad cryptocurrency support, and commitment to user privacy, the Bitrefill card is not just a payment tool but a statement of what the future of cryptocurrency usage should look like.

As the landscape of digital finance continues to evolve, the Bitrefill card positions itself as a leader, catering to the needs of a diverse and global user base. It's more than just a crypto card; it's a gateway to a more flexible and interconnected digital financial world.