What is a Crypto Card?

Essentially, a crypto card is a financial tool that integrates cryptocurrency into everyday commerce. It functions by converting cryptocurrencies stored in a digital wallet into local currency upon making a transaction.

This conversion allows users to effortlessly use their crypto assets for everyday purchases, from groceries to online shopping, just as they would with a standard bank card. Crypto cards often come with additional benefits like cashback in crypto, enhancing the appeal for crypto enthusiasts.

🥇Bitrefill - Best Ranked Online Shopping Platform & Crypto Card

Bitrefill is the biggest crypto ecommerce platform that offers a diverse range of products such as gift cards, phone refills, and eSIMs. One of the key attractions of Bitrefill is its accessibility; customers can make purchases even without owning a credit card or creating an account.

Buy Gift Cards with Bitcoin or Crypto

Pay with BTC, ETH, Binance Pay, USDT, DOGE, LTC, DASH

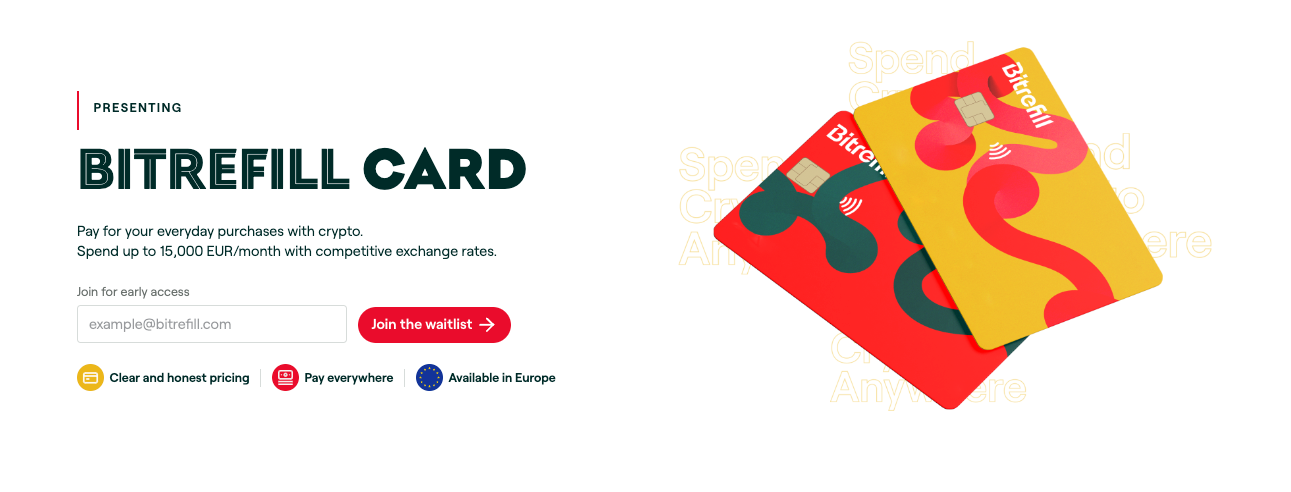

Bitrefill also offers its crypto card which has emerged as a top choice in the cryptocurrency card market, lauded for its exceptional flexibility, transparency, and user convenience. It stands out with its ability to support various cryptocurrencies like BTC, ETH, USDT and USDC, coupled with a transparent fee structure that eschews hidden costs.

Bitrefill Card: Pay anywhere using crypto

Top up your Bitrefill Card with EUR using BTC, ETH, USDC, USDT, BNB and more.

This transparency, along with a generous monthly spending limit of up to 15,000 EUR, contributes to its reputation as possibly the best crypto card available. Furthermore, its strong commitment to privacy, adhering to GDPR regulations, and forthcoming compatibility with major digital wallets like Apple Pay, reinforces its position as a reliable and user-friendly option.

These attributes make the Bitrefill Card a favored choice for those seeking a dependable and efficient means to manage their crypto expenditures.

Key Features:

- Multiple Cryptocurrency Support: Allows top-ups with a variety of cryptocurrencies like BTC, ETH, USDC.

- Transparent Fees: No hidden costs; minor conversion fees only.

- High Spending Limit: Up to €15,000 per month, surpassing many competitors.

- Wallet Integration: Compatible with Google Wallet, and soon with Apple Pay.

- Privacy Focus: Complies with GDPR for data safety.

Verdict: Ideal for those seeking a straightforward, flexible, and secure way to spend cryptocurrencies.

2) Coinbase Card - U.S. Centric Crypto Spending Solution

The Coinbase Card, a Visa debit card linked to Coinbase accounts, has garnered a mix of feedback from various users and reviewers. Its primary appeal lies in its convenience and security, allowing Coinbase customers to spend their crypto assets at any point of sale where Visa is accepted. This card is noted for being particularly user-friendly, offering a straightforward way for users to spend crypto for everyday purchases and receive crypto rewards.

However, it's important to note that the card also has its drawbacks. Some users have pointed out the high fees and a lack of reward options compared to other crypto cards. Additionally, there's a monthly spending cap that limits the potential rewards users can earn, and the value of rewards can be volatile due to the nature of cryptocurrencies.

Key Features:

- Visa Debit Functionality: Usable wherever Visa is accepted.

- Coinbase Integration: Links directly to your Coinbase account.

- Dual Spending Options: Spend from USD balance or convert crypto to fiat instantly.

- Rewards Program: Earn diverse crypto rewards on specific purchases.

- Flexible Rewards: Option to select from various cryptocurrencies for rewards.

3) Binance Card - Global Crypto Spendin (Shutting down on December 20th, 2023)

The Binance Card, recognized as a Visa debit card, allows users to utilize their crypto holdings from Binance for transactions, supporting various cryptocurrencies like Bitcoin, Binance Coin, Ethereum, SXP, and BUSD. This feature emphasizes the card's flexibility and integration with the digital currency sphere. Globally, the card's acceptance at over 60 million merchants across 200 regions and territories underscores its extensive reach and convenience for users worldwide.

It's important to note that the Binance Card is scheduled to shut down on the 20th of December. This closure marks a significant change for users of the card, especially those who have been relying on its features and benefits. With the discontinuation of the Binance Card, users will need to seek alternative solutions for their crypto spending needs.

Key Features:

- Prepaid Visa Card: Accepted in over 60 million stores globally.

- Automatic Conversion: Crypto to fiat conversion for purchases.

- Binance Integration: Direct link to your Binance account.

- Rewards: Up to 8% cashback in crypto on purchases.

- Varied Benefits: Cashback based on BNB holdings in Binance wallets.

4) Crypto.com Card - For Dedicated Crypto Users with Tiered Benefits

The Crypto.com Card, often hailed as the most popular crypto card on the market, offers a compelling way for users to spend their cryptocurrency holdings on everyday transactions. Users can earn up to 5% cashback rewards on spending, which is paid out in the CRO token.

This card operates as a prepaid card, allowing users to load various fiat currencies or cryptocurrencies for spending. It’s notable for having no annual fees and can be used globally wherever Visa is accepted.

However, the card is not without its drawbacks. High staking requirements for unlocking its features and obtaining maximum rewards, alongside various fees such as top-up fees, foreign transaction fees, and ATM fees, may deter some potential users. For instance, to access the 5% cashback, users need to stake €350,000 EUR in Cronos (CRO) for six months.

Key Features:

- Prepaid Visa Card: Accepted universally where Visa is available.

- CRO Token Benefits: Rewards linked to CRO token staking.

- Multiple Top-Up Options: Supports both fiat and crypto.

- Tier-Based Rewards: Earn up to 5% back in CRO.

- Extra Perks: Includes Spotify, Netflix rebates, and airport lounge access.

Frequently Asked Questions

- How Do Crypto Cards Work?

Crypto cards operate by linking your cryptocurrency wallet to a payment card, allowing you to spend your digital currency holdings as you would with a traditional debit or credit card. When you make a purchase, the card automatically converts the necessary amount of cryptocurrency into fiat currency (like USD or EUR), facilitating seamless transactions at retailers and online platforms. - Can I Withdraw Money from ATMs with a Crypto Card?

Yes, most crypto cards enable you to withdraw fiat currency from ATMs. They convert your cryptocurrency into the local currency when you make the withdrawal, just like they do for regular purchases. However, it's important to check for any associated fees or limits on ATM withdrawals specific to your crypto card provider. - How Safe and Secure Are Crypto Cards?

Crypto cards generally offer a high level of safety and security, similar to traditional bank cards. They often include features like two-factor authentication, encryption, and fraud protection to safeguard your funds. Additionally, since they are typically backed by established payment networks like Visa or Mastercard, they inherit the robust security measures of these networks. However, as with any financial product, it's essential to practice safe usage and be aware of the security protocols provided by your card issuer.